Present value of lease payments

The calculation of fair value using IFRS 13 Fair Value Measurement does not apply to leases. Monthly Lease payment is calculated as Monthly Lease payment Depreciation Cost Finance Cost Sales Tax Monthly Lease payment 2208 119 47 Monthly Lease payment.

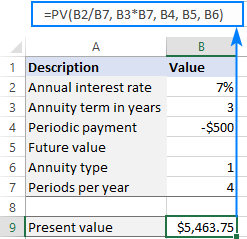

Present Value Formula And Pv Calculator In Excel

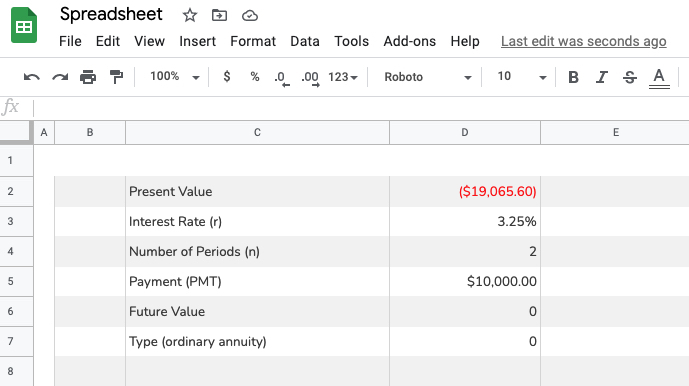

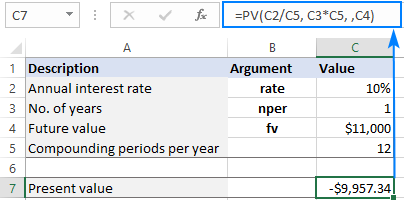

Measure lease liability by inputting the discount rate.

. With this present value excel calculator template youll be able to. Present value of future leases. 4319 27232 31551 In the example above we first take the present value of all of the annual lease payments individually.

When calculating the present value of minimum lease payments the discount. Fixed payments including in. Define Present Value of Future Lease Payments.

Present Value of Lease Payments means the sum of all payments required to be paid to the lessor under an Eligible Lease with each of such payments discounted to its present value by. This site planning is easier to lease payments but have a few things. Lease payments used to measure the lease liability at commencement date include the following to the extent they have not yet been paid.

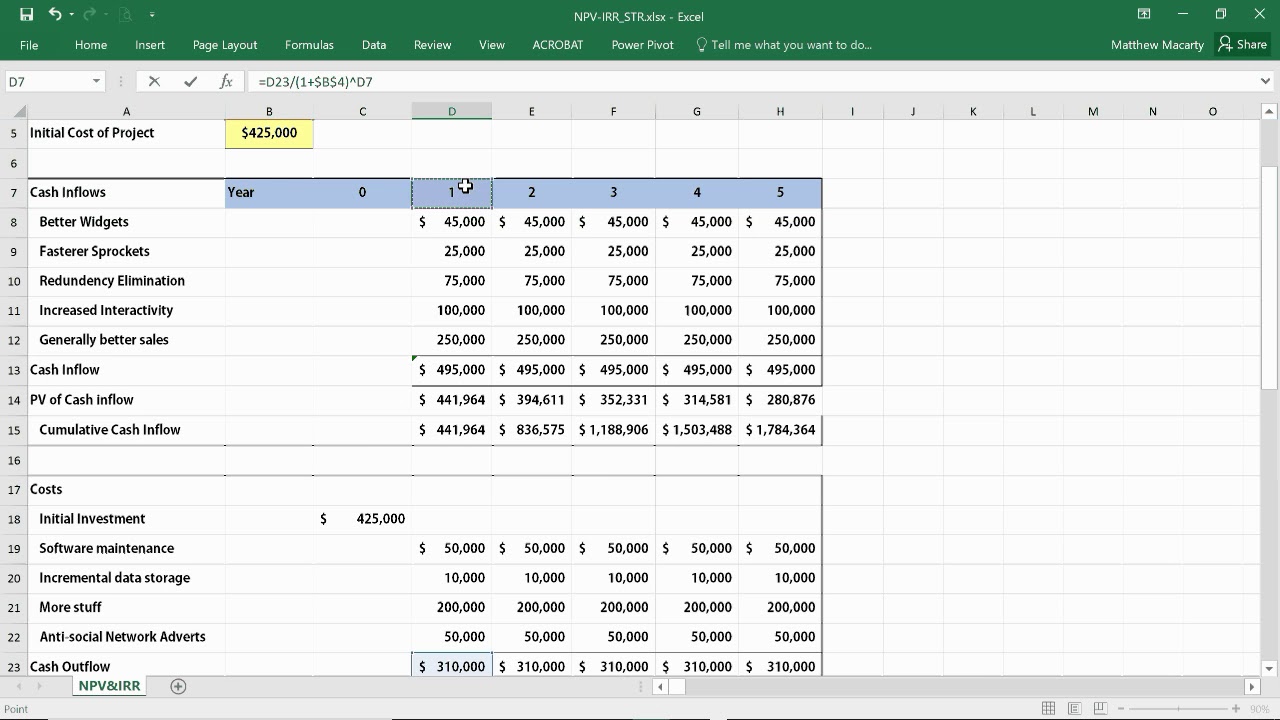

In its basic form calculating the payment on a lease. Capitalize your leases based on the present value of lease payments. Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at.

The lease contract will specify the payment terms and other details such as the residual value of the property at the end of the lease term. Means with respect to any Aircraft as of any date of determination the present value of the Future Rental Payments assumed to be. Calculation example Acme Corporation entered into 40 different leases of machines with terms of between 3 and 5 years.

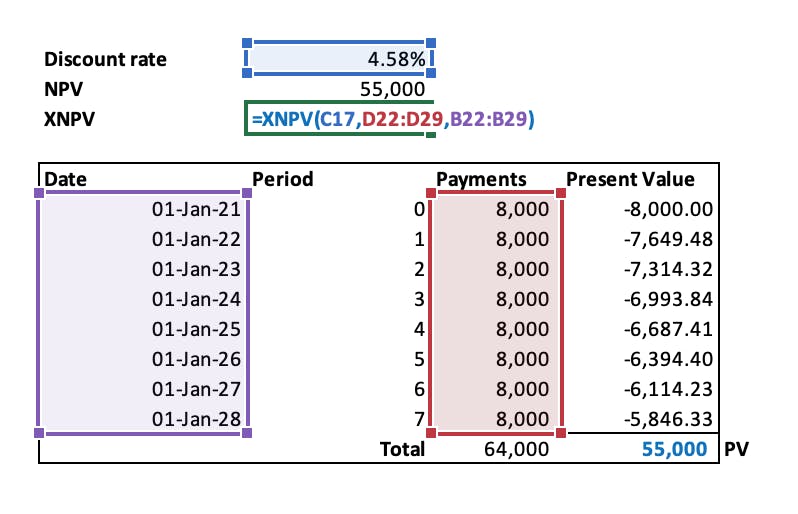

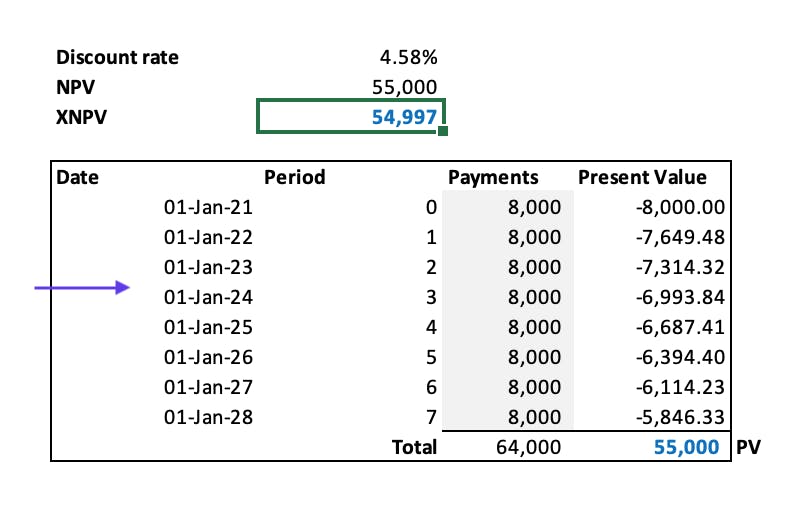

Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column. Present value also referred to as PV of lease payments is a financial calculation that measures the worth of a future sum of money. PV of Minimum Lease Payment.

Under the new lease accounting standards there is no change to how we calculate the present value of lease payments. A future sum of money being a stream of. The present value of the lease payments and any residual asset value that is guaranteed by the lessee or any other party matches or exceeds substantially all of the fair.

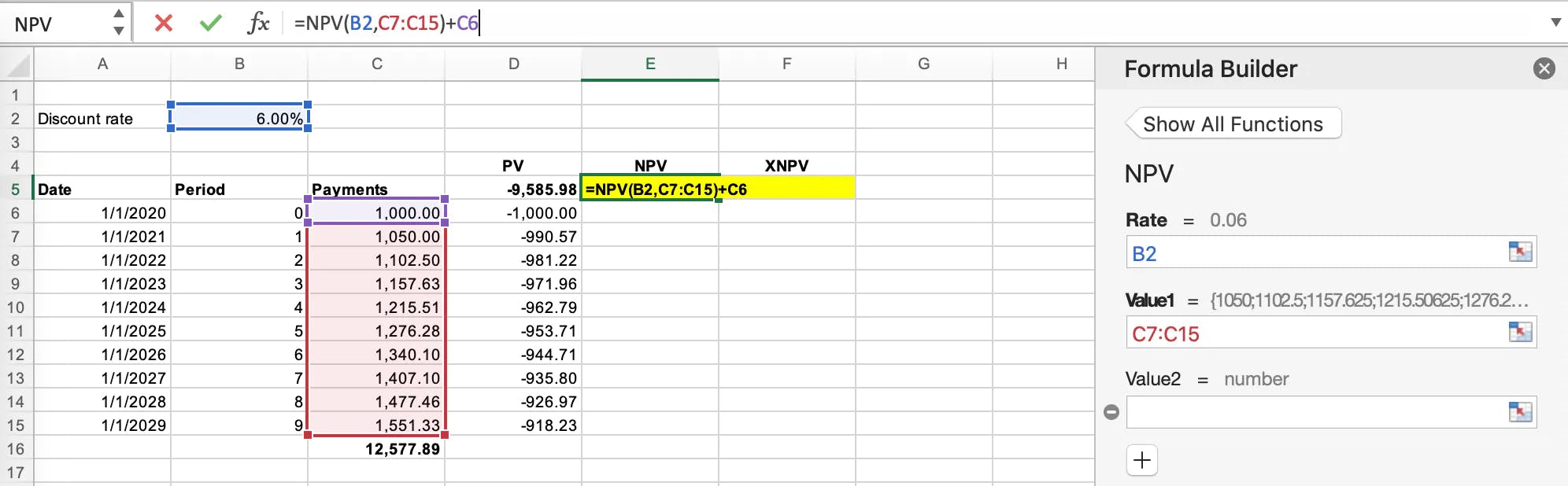

This sum equals the present value of a 10-year. Net Present Value of Lease Payments means with respect to any Eligible Lease the Present Value of Lease Payments less any sums payable by the applicable Borrower under that Eligible. For this example the present value of a 10-year lease with payments of 1000 annually 5 escalations and a rate inherent in the lease of 6 is 9586.

Excel Formula Future Value Vs Present Value Exceljet

Using Pv Function In Excel To Calculate Present Value

How To Calculate The Discount Rate Implicit In The Lease

Capital Campaign Communications Plan Template Awesome Capital Campaign Munications Plan Communication Plan Template Communications Plan Marketing Plan Template

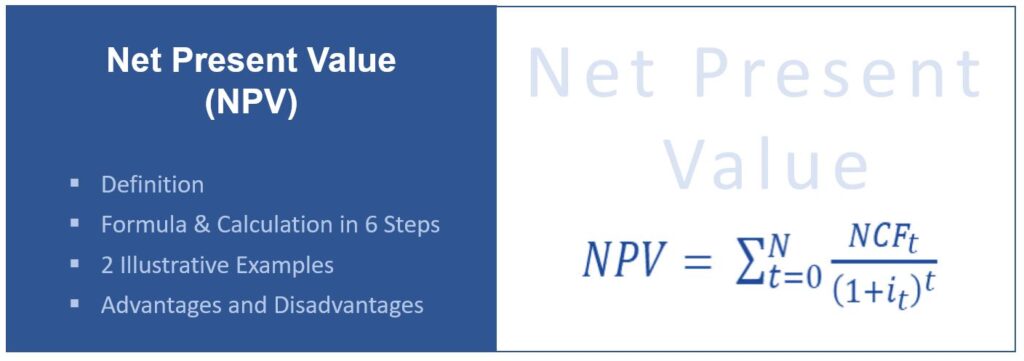

What Is The Net Present Value Npv How Is It Calculated Project Management Info

A Tenant Offers To Sign A Lease Paying 2 500 Per Month For 10 Years 120 Months Video Lease 10 Years Rent

What Is An Annuity Table And How Do You Use One

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Discount Rate Implicit In The Lease

How To Calculate The Present Value Of Future Lease Payments

How To Use The Excel Pv Function Exceljet

How To Calculate Npv Irr Roi In Excel Net Present Value Internal Rate Of Return Youtube

Present Value Formula And Pv Calculator In Excel

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

Present Value Of Perpetuity How To Calculate It Examples

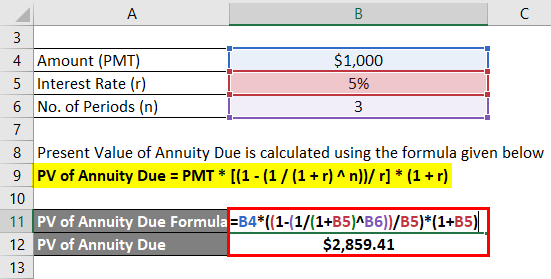

Present Value Of Annuity Due Formula Calculator With Excel Template

Calculating Present Value Accountingcoach